24 April 2016

Dear Fellow Investor,

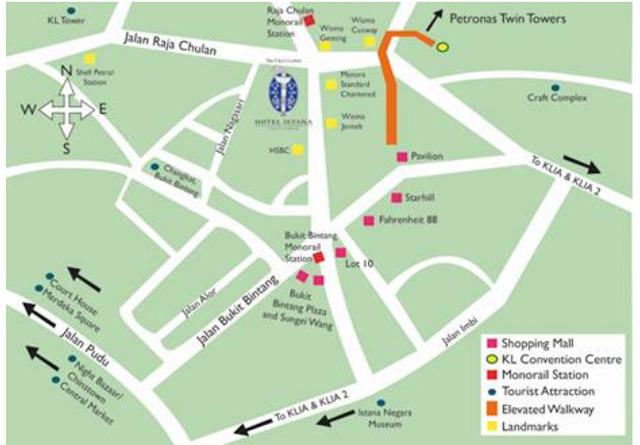

I would like to thank all of you who attended

our Asian market outlook at the Istana Hotel.

For those who were unable to attend, I will

summarize the key points:

Mr Phua, Phillip chief market strategist gave

his outlook on Japan: In search of Samurai and Ninja. The

Samurai is a direct threat and something that we see. He is obvious.

On the other hand for us to be profitable we must be like the Ninja.

A Ninja hides in

the shadows and is a hidden threat. A Ninja does not reveal himself and waits

until the odds are in his favour before striking. This would be a

metaphor for less researched companies not popular with the

investment crowd.

They could be

smaller companies involved with the sharing economy such as tourism,

restaurants, transportation with concepts of touch, taste, feel, pretty, health

and comfort. One example Mr Phua mentioned was Santen which offers a

unique method of eye drop delivery. This product is very popular with China

tourists.

Because tourism is

a major growth catalyst in Japan and the majority of tourists come from China,

Taiwan and Korea companies catering to their needs are performing well.

Many offer growth,

quality management and rising sales and earnings. They profit no matter what

happens to the huge multinational big caps. PE in Japan is only 12.2 which are

the lowest in developed markets.

This theme also

applies to investing in Malaysia, Thailand, Hong Kong and

Singapore. Be a Ninja and strike when the odds are in your favour.

Mdm Pikun, a fund

manager with Phillip in Thailand spoke about opportunities in Thailand. FDI is

the lowest in Asia and sentiment is overwhelmingly negative. The severe

El Nino drought has effected crop production, political uncertainty continues,

infrastructure projects have been delayed due to bickering by politicians but

the Thai index is up by 10 % this year driven by tourism and bargain

hunting. She recommended Threil an insurance company and SVI

a contract electronics manufacturer.

She also confirmed

my decision to buy Thai Beverage, an established spirits and beer company.

I bought these 3 years ago for some of my PGWA clients and continue to add for

my new clients. It has performed handsomely.

Charles Lee,

Portfolio Manager of Phillip Singapore spoke about opportunities in Singapore

dividend shares. Singapore offers the highest dividend yields of the Asian

markets. He likes selected Reits including Parkway Life Reit and Ascott Reit.

Tourism arrivals he said are picking up so he likes hospitality Reits.

He also likes SGX,

the operator of the exchange as well as OCBC and DBS Bank, and Silverlake, a

technology, Software Company.

The property market

is picking up due to policy easing by the authorities and mild depreciation of

the Sing Dollar. He showed a chart of the SGD/RM exchange

rate and showed that because of the price correction this is an attractive

time for Malaysian investors to enter the Singapore share market.

The last speaker

was Mr Louis Wong, Director of Phillip Hong Kong. He presented a positive

outlook for China showing that property prices in the cities are picking up as

there have been 6 interest rate cuts, 5 reserve requirement cuts and relaxed

home purchase requirements. Power consumption is also up 3.2 % last

quarter, PMI is up to 50.2 % which shows expansion and consumer spending is up

10.5 % last quarter.

He said more than

40 different business sectors benefit from house price increases which is a

crucial growth driver. As property prices recover, fiscal revenue increases for

the government.

He recommends

exposure to China via Hong Kong. He likes Bank of China Hong Kong, China

Mobile, CLP and CKI Holdings which we hold for our PGWA accounts. Peses

in HK are also 1 standard deviation below mean which show there is value.

I do hope this

summary is of value to you. Should you wish to diversify some of your

assets to these markets for currency stability and growth prospects do not

hesitate to contact me. They key is to be like a nimble Ninja and not get

slaughtered by the Samurai.

Invest well and

grow your wealth,

Bill

From 11 to 19 May, Dolly and I will visit Taiwan on a Reliance Tour and it will be interesting to learn more about this place. Many of you have recommended us to visit Taiwan so will keep you posted. The food looks clean, fresh and delicious.