21 August 2021

Dear Fellow Investor,

The EWM, an ETF of blue chip Malaysian shares traded on the NYSE rose 0.65 % Saturday. This is a positive reaction to the appointment of the new prime minister. Should professional investors have sold the EWM down that would have been a no confidence vote by foreigners on the KLSE and the new prime minister.

Notice the narrow range accumulation on above average volume over the last month. This is in the face of extreme pessimism, political uncertainty and fear of tapering being reduced by the US Federal Reserve. This would mean a slowdown of US money printing and the result being higher US interest rates. This would negatively impact stocks and bonds worldwide.

The other cloud overhanging the market is the pandemic. In Tong’s Edge column, he reports that the worst of the Covid-19 pandemic in Klang Valley is in the rear view mirror. He presented statistics: hospital admissions are turning lower and % of population in the Klang Valley with at least one dose is now at the 70% level and rising. Daily cases and daily deaths have been reduced. The decline in infections, hospitalizations and deaths is inevitable and was set in motion months ago with the start of our national vaccination program. This could be another reason we are seeing accumulation over the last month in the KLSE. Smart money identifies value at a discount and they act accordingly.

Last week, I said I would review 3 of our Singapore holdings. They are SGX, Parkway Life Reit. and OCBC bank.

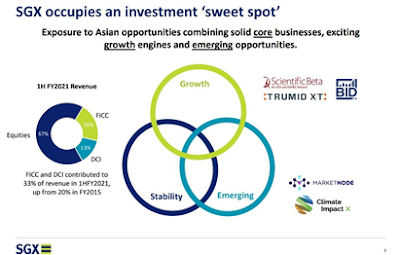

SGX is sitting in a “sweet spot” where it enjoys both growth and stability along with exposure to emerging opportunities.

With its core business stable and contributing steady profit and free cash flow, SGX has the opportunity to seek growth through collaborations, joint ventures and acquisitions.

The bourse operator is the only stock exchange in Singapore, endowing it with a natural monopoly.

SGX is also exposed to money flows from the Asian region, particularly China.

This exposure is beneficial to the group as China is viewed as being the next emerging superpower.

Source: Singapore Exchange Analyst Day Presentation Slides

From the diagram above, the exchange is sitting in a “sweet spot” where it enjoys both growth and stability along with exposure to emerging opportunities.

New initiatives such as Climate Impact X, a collaboration with DBS Group (SGX: D05), Temasek Holdings and Standard Chartered Bank (LSE: STAN), open up interesting possibilities for the group to add additional revenue streams. I like their plan to launch the biggest Asia FOREX platform

The recent 9 % correction allows us to buy/ add at a cheaper valuation.

Parkway Life Reit.

Parkway Life REIT is in a league of its own, being one of the only REITs that can boast an uninterrupted increase in its recurring distribution per unit (DPU) since its IPO in 2007.

This week, the healthcare REIT announced the signing of new master lease agreements for its three Singapore hospitals.

The new lease agreements will run for around 20.4 years, from 23 August 2022 till 31 December 2042.

Beyond the initial term, Parkway Life REIT has the option to renew these leases for a further 10 years till 31 December 2052.

The new leases are signed with IHH Healthcare Berhad (SGX: Q0F), an international healthcare services provider that employs 65,000 staff across 80 hospitals in 10 countries.

As part of the agreement, Parkway Life REIT will also commit a one-time capital expenditure (capex) of S$150 million to revamp all three Singapore hospitals.

The capex will commence no later than 1 January 2023 and is estimated to take place over three years.

Parkway Life has enjoyed revenue from its Japanese nursing home assets and supported by insider buying as well.

It is the primary health care asset in our portfolios.

OCBC Bank

New group CEO Helen Wong said that the lender saw growth in multiple areas, driven by the strength of OCBC’s diversified franchise.

The broad-based growth saw the bank achieve a net profit of S$1.16 billion for the quarter due to higher fee income and reduced allowances.

OCBC’s financial and operating numbers demonstrate the bank’s resilience and ability to continue growing even as the world slowly recovers from the ravages of the pandemic.

Here are five things that investors should want to know about the bank’s latest earnings.

1. A surge in net profit

2. Net Interest Margin has stabilised

3. Steadily-increasing assets under management

4. Lower overall allowances

5. Interim dividend raised

These reports are from Smart Investor, Singapore and extracted from latest company quarterly reports.

Biden’s supporters are turning on him based on his handling of the on going Afhgan crises. Especially those who have sons, relatives, friends and daughters in the military. There are calls for him to resign and this could be the catalyst for a correction in US/ World market shares. The shares I reviewed in todays report should not be affected no matter what Biden does.

Keep safe

Bill

No comments:

Post a Comment